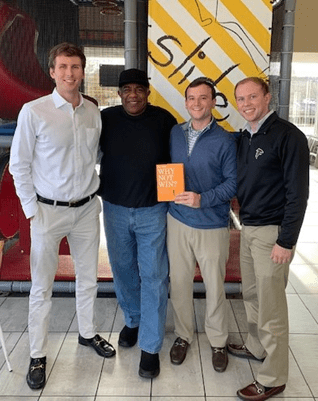

VIVA Finance is excited to begin offering our financial wellness benefits to employees of Larry Thornton’s McDonald’s franchises in Birmingham, Alabama. This opportunity is especially important to us given Mr. Thornton’s stature as a champion of equality and inclusion. Larry has been breaking barriers for decades; from overcoming oppression in the education system as a member of the first integrated class at Montgomery’s Goodwyn Middle School—to his mercurial rise through corporate America on the way to becoming the first African American McDonald’s franchise owner in Birmingham. Mr. Thornton’s personal triumphs and community initiatives are virtually innumerable, and you can read more about his incredible life in his autobiography, Why Not Win?: Reflections on a fifty-year journey from the segregated South to America’s boardrooms – and what it can teach us all.

Larry currently owns four McDonald’s franchises in the Birmingham area with his son, Dale, and the father-son duo will now be among the first franchise owners in the nation to offer financial wellness benefits to their employees. We are proud to stand by Larry and Dale in their efforts to improve the financial well-being of their employees and combat financially driven problems that plague the area. Alabama is one of the most affected states by the payday lending epidemic, where usurious rates and short loan durations often lead to perilous cycles of expensive debt. Payday lenders are often a last resort for those with no other option in a financial emergency, thereby preying on the financially vulnerable. As of 2017, there were 1,177 payday lending storefronts operating in the state of Alabama—the sixth most nationwide and over five times the number of McDonald’s restaurants in the state.[1]

By providing access to low-cost loans and financial education as an employee benefit, VIVA offers a better alternative to predatory lending and equips employees with a toolkit to make more empowered financial decisions. For example, a $500 payday loan may come with an effective APR of 456.25%, whereas a comparable VIVA loan carries an effective APR of only 19.78%. VIVA’s loans are based on employment data instead of credit score, which enables lending to working Americans at affordable rates regardless of their financial history. Even though access to loans is not based on credit score, employees can still build their credit through the repayment of a VIVA loan—and VIVA’s loans are serviced through automatic payroll deduction, so repayment is as effortless as possible.

Employees of Thornton McDonald’s franchises will also have access to VIVA’s financial education resources and a toll-free financial counseling hotline. VIVA’s financial education is geared toward managing the financial aspects of daily life and covers key topics including becoming a homeowner, using a checking account, and developing savings habits. Employees can easily access all of these resources through their Financial Wellness Dashboard on our website (www.viva-finance.com).

We are grateful for Larry and Dale’s vision in implementing our financial wellness benefits and consider this an invaluable opportunity to pursue our mission of financial inclusion and empowerment.

Sincerely,

The VIVA Team

[1] “McDonald’s vs. Payday Lenders” California State University Northridge. Accessed March 6, 2017. http://www.csun.edu/~sg4002/research/mcdonalds_by_state.htm